Trading System & Strategy

Over the last 15 years we have studied and participated in the foreign exchange marketplace acquiring formal training, completed extensive research, beta tested our strategies enabling the development of our statistical trading system that minimizes risk while maximizing returns.

Our unique systematic trading strategy is fully automated using proprietary mathematical algorithms and economic models. An economic model is a theoretical construct that represents a process by a number of variables and a set of quantitative or logical relationships between them to determine what might happen in different scenarios.

One trade sequence is placed per day only if the market conditions fit the statistical parameters. The trade is usually closed out the same day. Occasionally such positions are held overnight until targets are reached.

The trading system is formulated with a set of predefined numerical inputs that incorporate various factors around potential breakout areas. Unless a currency breaks out in a certain direction, no trade is placed.

Our custom-built automated trading system (ATS) is a subset of algorithmic trading, used to execute buy or sell market orders on an MT4 trading platform. The trading system is a combination of a proprietary developed money/risk management trading system with a built-in statistical analysis of the daily markets in order to capture intraday breakouts.

A breakout occurs when a currency price has broken through a defined support or resistance level with increased volume. The trading system seeks to identify these patterns that have historically and statistically resulted in high probability breakouts.

Research suggests that currencies move in trends and behave in predictable ways around highs, lows, and areas of support and resistance. Often a currency will break out in a certain direction. Breakouts indicate the potential for a currency to start trending in the breakout direction.

If a false breakout occurs and the market reverses its direction before reaching the profit target calculated by the trading system, the negative position is managed in accordance with our unique stop-and-reverse statistical trade management system. This system has been created through research on probability distribution around losses.

Limit orders and stop losses are calculated, then automatically implemented in accordance with dynamic parameters. Expected daily range, previous daily range, and the amount of risk capital is all pre-programed into the trading system before a trade placed.

A drawdown is a peak-to-trough decline during a specific period for an investment.

Analyzing the trading systems historical daily drawdowns has played a pivotal role in our trading systems success. It has allowed us to manage and minimize risk exposure before a trade is placed.

Sterling Rise’s trading system has a built-in algorithmic formula designed to course correct any daily or accumulated daily drawdowns. The largest recorded “daily accumulative” drawdown over the last 5 years has been 12%. Sterling Rise’s trading system has consistently averaged a monthly return of 4.73% on a 12-month rolling.

What Makes Sterling Rise Global Trading System Unique?

Fully Automated – Precise execution every time with no emotion or decision making required by a human.

Statistically Profitable –Analyzing and theorizing the implementation of the trading systems performance history to date has consistently resulted in exponential growth in returns.

Hedged – The trading system automatically executes limit orders that seek profit on a strong movement in either direction as well as stop and reverse orders in certain market conditions to eliminate the negative effect of false breakouts.

Dynamic – The conception of the trading system was created after years of analyzing market data on a daily basis, comprehensively analyzing market trends, market patterns, and how currency pairs behave.

We have constructed complex financial models that have stress-tested the trading system in different market conditions and developed such system to withstand these conditions. If market conditions change in the future our system is easily customizable from changing inputs in our financial models to respond to changes in the markets.

Risk Management – Our trading system utilizes a custom-built risk management program that increases lot sizes by a definable percentage. The model factors in a maximum drawdown by determining lot size relative to the original working capital. This enables the trading system to experience high performing returns with a limited initial draw down.

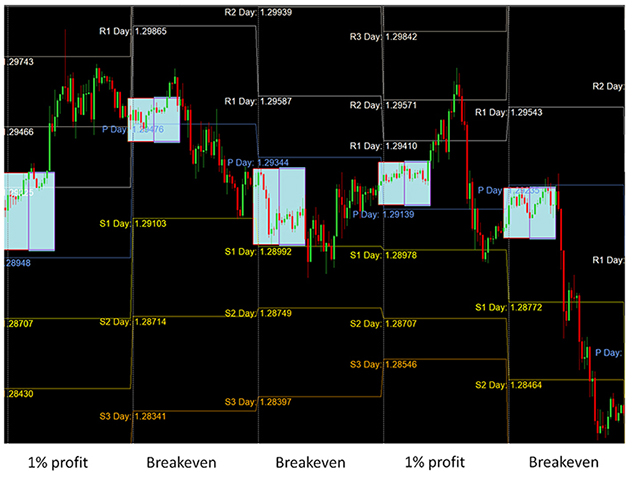

ILLUSTRATIVE SNAP-SHOT OF THE TRADING SYSTEM (5 days)

Light Blue Represents Automated System Trades

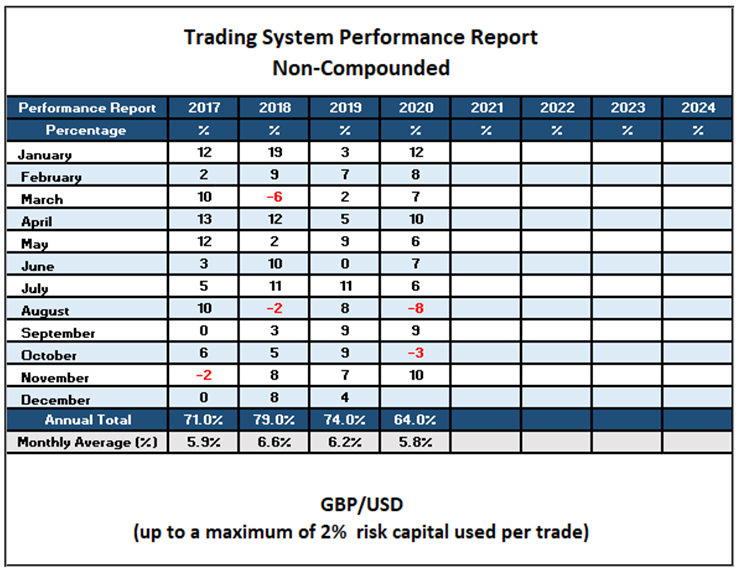

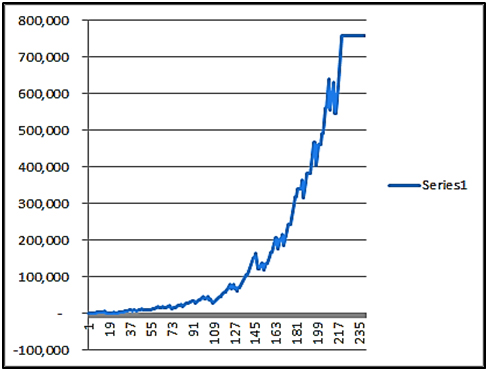

Trading Systems Performance Results 2019

GBP/USD

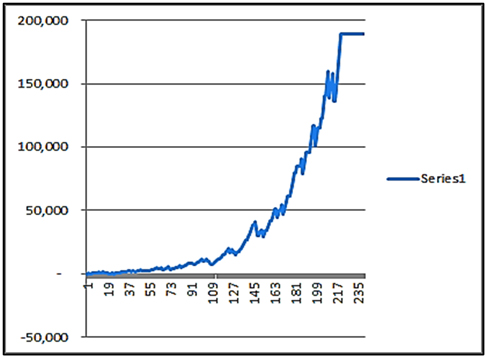

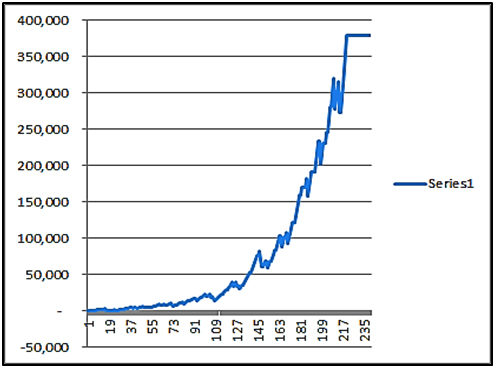

Compounded 235 Trading Days

$25,000

$50,000

$100,000

STERLING RISE GLOBAL TRADING BROKERAGE FIRM

FXCM UK – Forex Capital Markets Limited

Forex Capital Markets Limited (FXCM LTD) is authorized and regulated with the Financial Conduct Authority (FCA) of the United Kingdom. FCA Registration Number 217689.

FXCM LTD is a leading provider of online foreign exchange (FX) trading, CFD trading, spread betting and related services. Founded in 1999

FXCM LTD meets strict financial standards, including capital adequacy requirements. On a regular basis, FXCM LTD is required to submit financial reports to regulators. These standards are enforced by the FCA, which has the right to fine firms and terminate their regulatory status for violations.

Client Fund Security

Accounts, with FXCM LTD are segregated in accordance with FCA client money rules. In the unlikely event of FXCM LTD insolvency, segregated client funds cannot be used for reimbursement to FXCM LTD creditors. If FXCM LTD is unable to satisfy repayment claims, eligible claimants have the right to compensation by the Financial Services Compensation Scheme, up to £85,000.

FXCM’S Group Liquidity Providers

Global banks, financial institutions and other market makers included in FXCM’S Group Liquidity Providers are: Barclays Bank PLC, Citadel Securities LLC, Citibank N.A, Deutsche Bank AG, Morgan Stanley & Co. LLC, Commerzbank, Jefferies Financial Services Inc.

FXCMInternational Offices

FXCM UK – Forex Capital Markets Limited

FXCM Germany – Forex Capital Markets Limited

FXCM Australia – Forex Capital Markets Limited

FXCM France – Forex Capital Markets Limited

FXCM Italy – Forex Capital Markets Limited

FXCM Israel – FXCM Israel Limited

FXCM Greece – Forex Capital Markets Limited

FXCM Hong Kong – FXCM Bullion Limited (Gold/Silver Bullion TradingServices)

Caye International Bank Ltd.

Private offshore banking in, Belize Central America offers a significant number of concrete advantages that you simply cannot get from investing within any American, Canadian, or European based banks.

Caye International Bank has been named the best offshore private bank in Latin America by Wealth & Finance International for 2019. The award highlights Caye’s exceptional financial services performance in the competitive Latin American marketplace.

Privacy

- Belize has a stable growing economy with a zero-tax jurisdiction, and strong bank secrecy laws, which benefits CayeBank clients through increased privacy and confidentiality.

- There are no exchange controls in Belize, which means that funds can be withdrawn or deposited anytime, and your banking information will always remain private.

Stability

- Belize is politically stable with a local currency that is pegged to the United States dollar at a fixed rate of 2:1. This means that bank clients can have confidence that their money is safe, and that currency devaluation will not occur. Additionally, Belizean asset protection laws ensures that bank client assets held under certain structures. (for example: IBCs & trusts are protected from lawsuits, judgments, and divorce settlements.)

- In addition to asset protection, investors can also feel safe when depositing their money in Belize because essential bank reserve requirements in Belize are at least four times the reserve requirements of those in the United States for their local banks. An example of this is Caye International Bank, which has one of the highest liquidity ratios of any global bank. (currently at approximately 24%.)

Trust

- Caye International Banks Management Team consists of international experts with extensive financial experience across many sectors and industries whose primary mission is to manage, preserve, and enhance the wealth of all bank clients.